We have gotten used to Google’s prompts to leave for work, avoid traffic, or to come home. Being governed by an external party to plan our schedule doesn’t seem domineering if it’s a bot. We trust bots more than people these days. Why is that?

Bots function on data driven analytics and insights. The directions given by them function on programmatic deductions as compared to humans whose decision making is always influenced by emotions. Emotions can make our decision making illogical. However, intuition is a gift that humans possess. Intuition is the art of thinking without thinking. It is the subconscious talking to us after having done all the multiplications and calculations.

The art of thinking without thinking. The art of removing complexities and confusion. We trust bots because bots are not confused and hence don’t confuse. The decision making may turn out to be faulty at times but that is not often and hence the reliance.

Bank Relationship Manager vs the Chatbot

As a bank customer, would I rely more on my relationship manager or on a bot telling me what to do when I login net banking?

Imagining the situation in my head, I think both will be of help.

I love being human, I love connecting to people and talking. It’s always a joy to be greeted by my Relationship Manager. It feels good when they make a call to update me on my holdings. Thinking about the bot, I am of the opinion that it would help to automate some tasks.

Human interactions take longer turn-around time. While my Relationship Manager takes a certain amount of time to procure the information and my work then depends on his turn-around-time. I am guessing a bot would offer immediate solutions for the most basic and essential requirements. Another point observed is that Relationship Managers change from time to time, sometimes quite often. I get a new message declaring a change of person. Not only it’s very difficult to keep a tab on the names but it’s also very confusing to keep track of the communication.

What do the leaders in the banking sector think?

I read a write-up on a panel discussion in the 5th International Exhibition and Conference on Banking Technology, Equipment and Services which occurred in the month of January this year. Ms. Aruna Rao, Chief Technology Officer, Kotak Mahindra Bank stated her views on the power of data analytics and the way mobile devices govern our lives. She narrated an event from her life when she received a prompt from her mobile device, she said “It knew that I left from point A at this point of time and reach point B at a certain time, and that was my daily routine. They put this together in a very nice news case to give me this alert. They topped it up with a little chatbot. So, you can see five technologies coming together to deliver an enhanced experience. But I just want to dwell a minute on my feelings on this. I was amazed, I found it useful… like a personal assistance to follow me around and help.”

Technology has been changing our lives in so many ways. Location sensing is just one aspect. The next level of empowerment takes one to a plethora of different ways in which geofencing can be used. Beacons for example function on the same idea. Based on my location, beacons can initiate a line of conversation which can be perfectly timed. I receive discounts and offers from my bank. If the utility of such offers is not immediate I tend to keep it at the back of my head and may or may not use it later. But if the offer is so well timed that I receive the offer right when I need it, then there is 100% chance that I will use it. When I need a home loan, I am bound to do my own research about the existing rates in different banks before I reach out to my RM to give me a better quote. If I receive a notification in the meantime with a customized quotation or not even that, just a note to tell me that since I have been looking for home loan rates would I be interested in connecting with the RM. That is real time marketing. That is where the world is headed and that is the kind of proactivity customers desire from all touchpoints.

Another industry person who shared his point of view in the discussion was Mr. Amit Saxena, Deputy Chief Technology Officer (E-Channel), State Bank of India. He said, “At SBI we are trying to leverage multiple channels because we understand the future is not only through mobile or internet banking. We are trying to see what kind of experiences the customer expects from the bank. Customers have become very smart, they look for services as per their own convenience – so they do not want to visit the branches, they want new and better offerings which would suit their requirements.”

How would that happen?

Branch banking is the last resort people take, a resort when nothing else works. I call my RM or the banks service number first in any case of requirement. Considering the scenario where people want more ease and comfort, what are the contemporary technologies that cater specifically and profitably to the banking industry?

New Age Marketing Solutions – Beacon technology.

Beacons are being widely used to leverage on proximity sensing. They can be strategically positioned in the branches or at retail stores to send notifications to the customer. The context of the notification can be modified further to suit the customer. Digitized personalization is common in the retail industry, banks have yet to explore this aspect of big data.

Technology brings about a smooth experience by serving to the customers requirement when they look for it. For example, I go to a retail outlet. I identify an outfit that I want to buy. The beacon located in proximity is detected by my mobile device, my location and the product that I wish to buy are captured. I receive an automated message that says I will get this dress at 20% discount if I use my credit card. I want to buy the outfit, I get a discount, I use my banks credit card. It’s a win-win!

Another example-say if my bank has a tie up with a travel services provider, I get mails that say I will get a certain amount of discount on booking an international flight if I use my credit card. That is the kind of marketing that is already in practice. The next level of automation is when you receive this message in real time. I get a notification of the offer when I go online to book my flight. Likelihood of using the offer? Probability is one.

If someone keeps a tab on all this data, collate it and analyze to understand my regular buying behavior, it will enable them to build my profile and know which offers I will use. This helps me as I am not being subjected to unnecessary noise and helps them cut the extra expenditure. Customer profiling offers deeper understanding and fine-tuned marketing and specified communication.

If you know that a client is an aggressive investor, is it not poor marketing and business acumen to show him advertisements for a moderate or low risk fund. When bankers are so vigilant and alert in person, is it smart to make digital marketing so vague and ineffective?

The tech crux – Cross device targeting, Data exchange and Transparency

The age old saying – sharing is caring – takes us to the next level of technological innovation. Collaboration empowers all parties, that is how we reach new realms of knowledge, capability and expertise. Fusion and collaboration of different technologies is the way of customer service. It simplifies the decision making of the customer by binding different platforms to offer one consistent solution.

Have you ever counted how many gadgets you use throughout the day? I use my mobile phone, then the laptop at work, I come home and continue my work on my personal laptop. Three devices at least and at times I use my spare old laptop when I face any technical issue with the new one. Device switching is a common occurrence, I may have started browsing on my phone, then switched to my laptop after having identified a product. The bank’s application can identify me via the mobile phone but can it identify me as the same customer when I go online on my laptop?

It can. That is cross device targeting. This tech practice is helping organizations reduce the customer’s subjectivity to the same message multiple times. The business can reduce efforts and channelize them towards more productive avenues and do away with the cacophony of offers the customers have to endure.

Exchanging data or using third party applications and cross device marketing efforts though easily applicable to other industries, I wonder about the security aspect when the same is applied to the banking industry. Transparency of data exchange has high criticality, the security measures in place when concerning customer data must be stringent. Is this coalition between technologies and platforms secure?

The level of exchange depends on the terms and conditions of the partnership between the benefiting parties but a huge role lies with the customer as well. Do we read before agreeing to the terms and conditions of the application we use? Do we use secure channels of transactions? A bank offers as much cyber protection it can offer. Only mutually beneficial data that can enhance the shopping experience is shared and that too with prior approval of the customer.

Communication as a solution – Programmatic Advertising

Trust is the first aspect of any relationship. I would never put my money in a commerce that is unreliable. I trust my bank and relationship manager and that is a result of consistent performance and continued communication. I have never been subjected to products that do not suit me. Their communication with me is clear, appropriate and caters to my requirement.

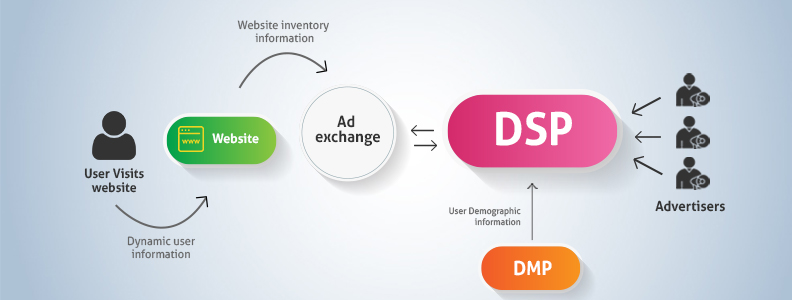

That is the level of precision that I expect from the bots. That is programmatic advertising. Delivering effective communication to the right person in real time. We know about optimizing our web sources to respond to certain specific keywords. How about changing the game for a role reversal? Why wait for the customer to define the keywords for you? Be intuitive. Know what will interest the customer. Segmentation based on age, demographics, browsing interests, wish-list or shopping-list can give a marketer many new ways of directing marketing spends and channelizing them in a much more productive manner.

New age marketing is all about utilizing your resources in the best possible way. Unite technologies and the point of interactions to offer a seamless and hassle-free experience to the customer.